|

Preparing for Single Touch Payroll (STP) Phase 2 with Q6.

Reporting via STP Phase 2:

Phase 1 of STP (PAYEVNT.2018) required employers to report aggregated total of YTD gross income amounts. As social services agencies assess income differently, STP Phase 2 will require a move to Disaggregated Gross model to provide more accurate and relevant employment income information.

Although Q6 kept STP reporting category changes to a minimum, the following changes are required to be reported to the ATO as per their reporting requirements.

Paid Leave. For example - Annual Leave, Sick Leave, Long Service Leave

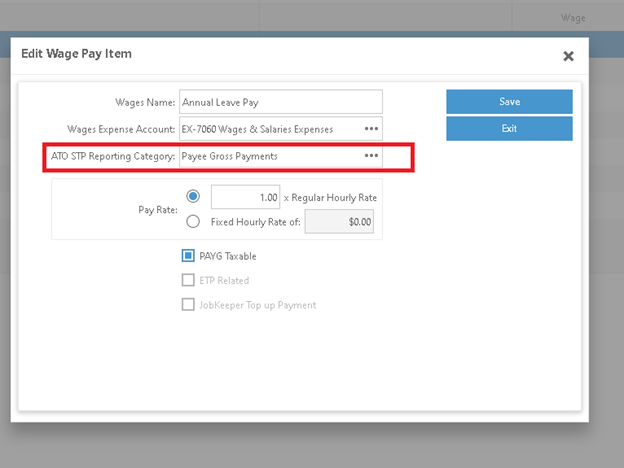

1.1 In STP Phase 1, Annual Leave Pay and Sick Leave Pay etc. were recorded under “Payee Gross Payments”

.png)

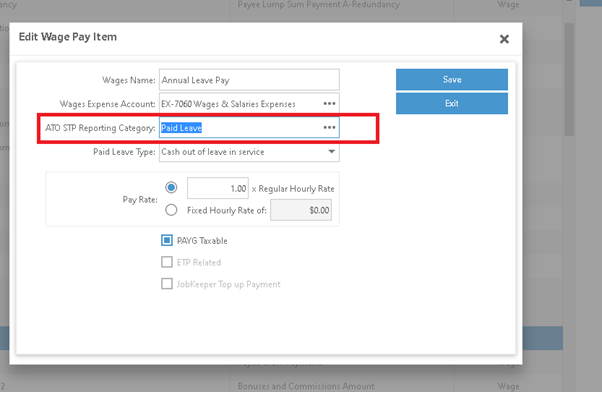

1.2 From STP Phase 2,

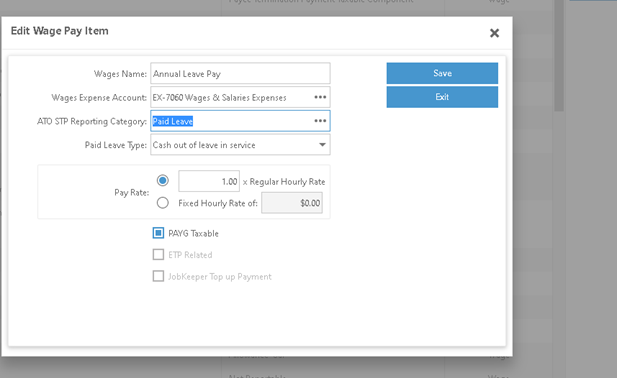

You need to choose “Paid Leave” reporting category. You will not be able to choose “Payee Gross Payments” anymore.

2. With STP Phase 2 we have a new payroll reporting category

2.1 Child Support Garnishee Amount

2.2 Child Support Deductions Amount

.png)

3. Salary Sacrifice

3.1 Salary Sacrifice and RESC

Use this to assign salary sacrifice super pay items.

.png)

3.2 Salary sacrifice - other employee benefits

For deductions that are for benefits from an effective salary sacrifice arrangement, including those exempt from FBT.

.png)

3.3 You cannot use “Reportable Employer Super Contribution” below for STP Phase 2 salary sacrifice anymore.

.png)

Do I need to do anything before lodging STP Phase 2 events?

Once you've set up your payroll and before you begin lodging pay events under STP Phase 2, please ensure you have created and lodged an Update Event so the ATO can validate the data that will be transitioned over to STP Phase 2.

If you have already submitted your STP report for 1/07/2021, then you will need to manually convert relevant data (For this payroll year, you do not need to report previous year’s payroll). If you fail to manually convert, then in this year’s payroll (1/07/2021 to 30/06/2022) STP 1, and STP 2 reports will be mixed.

This will cause EOFY final report to have an inaccurate gross amount.

Please see below picture 1. (For more detailed information please see attached file)

Let's use Paid Leave pay item for this example. (*in our opinion, most of the time you only need to do Annual Leave, Sick Leave, and Long Service Leave as manual conversions)

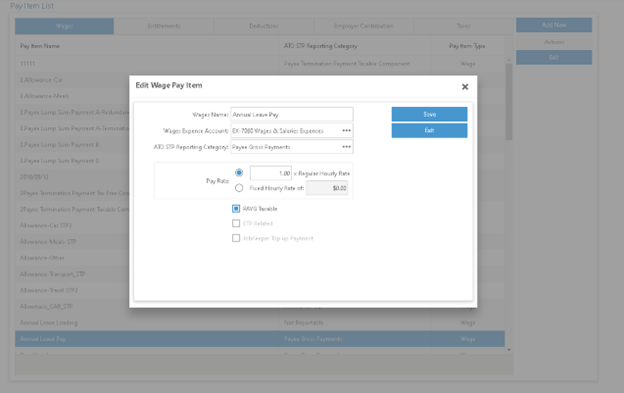

1.In STP Phase 1, Annual Leave Pay, Sick Leave Pay belongs to “Payee Gross Payments”

2. In STP Phase 2, it belongs to “Paid Leave”; does not belong to “Payee Gross Payment” anymore.

STP Phase 2 category will only be available after Q6 launches STP Phase 2.

If you have already submitted your STP report for 1/07/2021, then you will need to manually convert relevant data (For this payroll year, you do not need to report previous year’s payroll).

If you fail to manually convert, then in this year’s payroll (1/07/2021 to 30/06/2022) STP 1, and STP 2 reports will be mixed. This will cause EOFY final reports to have inaccurate gross amounts.

The bookkeeping steps for each company file from (1/07/2021)

STEP 1.

Go to pay item list - then open existing Annual Leave Pay and Sick Leave Pay.

STEP 2

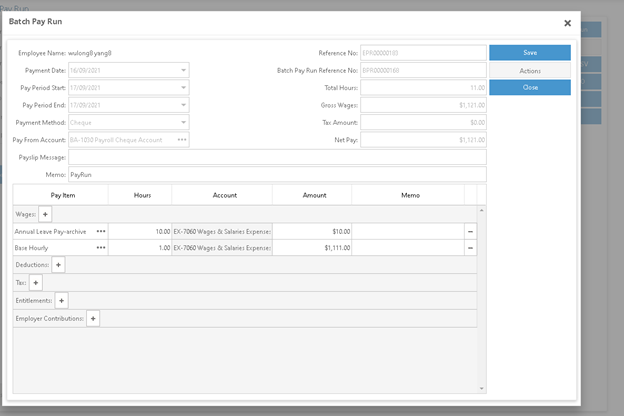

Change existing Wages Name - from Annual Leave Pay, to another name. (For example, Annual Leave Pay_archive)

STEP 3

Create a new Annual Leave Pay pay item. Using the ATO’s STP reporting category” Paid Leave” and save it.

STEP 4

Open each Batch Pay Run from (1/07/2021) and go to each employee’s pay detail screen; you can see Annual Leave Pay_archive pay item here.

STEP 5

Remove the Annual Leave Pay_archive pay item and add the newly created Annual Leave Pay item with the same amount and click the save button.

STEP 6

Follow STEP 5 for each employee in this pay run batch.

STEP 7

Click the “Post Batch Pay run” button to save this pay run batch.

With this pay run batch, you won’t be able to submit STP reports. Once the above steps are completed, it will already update the system backend.

As above steps update the system backend, when you do the next new pay run and submit STP reporting, the system will submit new updated STP reporting to the ATO.

|