|

Definition

Usually pension or superannuation liabilities paid by an employer for an employee.

Generally, Employee is entitled to super guarantee contributions from an employer if they are 18 years old or over and paid $450 or more (before tax) in a month. It doesn't matter whether they are full time, part time or casual, and it doesn't matter if they are a temporary resident of Australia.

Create an Employer Contribution

1.Go to Settings > Pay Item List;

2.Click Employee Contribution > Add New;

3.Fill the required information;

4.Save.

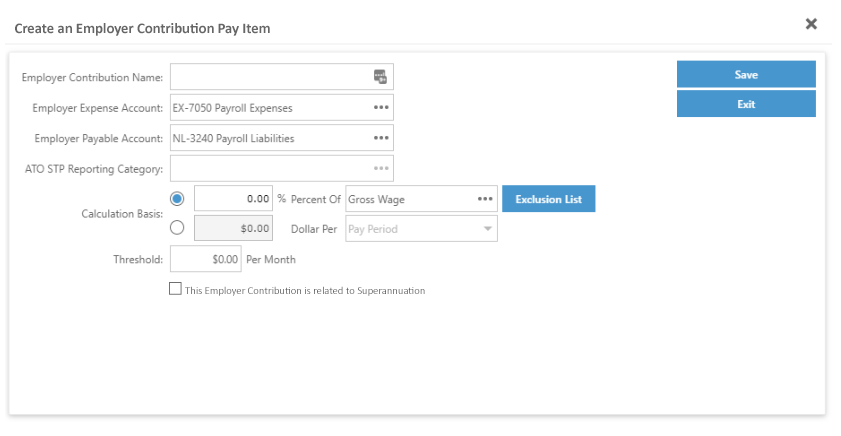

Employer Contribution Pay Item Fields Explained

1.Employer Contribution Name: This is a mandatory field, which cannot be left blank. User may assign a unique name describing what this Pay Item is about.

2.Employer Expense Account: This is the correspondent expense account for the Employer Contribution. In this case, Payroll Expenses Account is the selected account by default. And only Expense account is required in this field.

3.Employer Payable Account: This is the correspondent account to pay out the Employer Contribution. In this case, NL-3240 Payroll Liabilities is the selected account by default. And only Liability account is required in this field.

4.ATO STP Reporting Category: This Category settings is required by ATO Single Touch Payroll (STP) process. Any Pay Item required to be included in STP report to ATO should select one of the categories from this section. And also any item user may not wish to be included in the STP report should not select any ATO STP Reporting Category.

5.Calculation Basis: User may set up individual formula for each Employer Contribution through the Calculation Basis.

a.Percentage: User may enter a percentage to calculate against one of the Pay Item Wages in the next field, and specify any Pay Item excluding from the calculation in the Exclusion List, where it has included the entire hourly wage list. Multiple options are available inside the Exclusion List.

Let’s take an example on how exclusion list works.

If a user has selected Overtime (2 x) from Exclusion List, and generate Pay Run with settings of 5% Salary Sacrifice Super on Gross Wage, then the overtime hours would not be taken into calculation on Salary Sacrifice Super no matter how many overtime hours have been done. However, if Overtime (2 x) is not selected in Exclusion List, then the overtime hours needs to be added into total hours calculation for Salary Sacrifice Super.

A number would indicate how many Pay Items have been selected from Exclusion List behind the field.

b.Fixed Rate: User may enter a fixed amount to be add on per pay period, no matter it’s Pay Period, Hour, Month, Year.

5.Is this deduction related to Superannuation is not selected by default. Once user has selected this option, another field would display for selection which is the Preferred Name for Fund. User is required to specify one of the Fund products from the list or add new fund. And the above Default Payable Account would change into NL-3260 Superannuation Payable account automatically.

6.Threshold: It is set to $0.00 by default, and only positive number with maximum 2 decimal places is allowed. If a user ticks "This Employer Contribution is related to Superannuation", Threshold will change into $ 450 automatically which is the current(FY2014/2015) minimum monthly payment requirement for Compulsory Employer Contribution.

a.If user has selected Weekly Pay Run, then $103.85 (450 x 12 / 52=$103.85) is the minimum required payment to load the Compulsory Employer Contribution with correspondent percentage.

b.If a user has selected Fortnightly Pay Run, then $207.69 (450 x 12 / 26=$207.69) is the minimum required payment to load the Compulsory Employer Contribution with correspondent percentage.

c.If user has selected Weekly Pay Run, then $450 is the minimum required payment to load the Compulsory Employer Contribution with correspondent percentage.

7.Save: Once it has been saved, the Pay Item would be included in the Pay Item List.

8.Exit: Once a user clicks Exit, it takes you back to the Pay Item list.

|